INTRODUCTION

The Federal Reserve System (FRS) is the third central bank in American history. The original system included the federally chartered First (1791-1811) and Second Banks of the United States (1817-1836). Both issued currency, accepted deposits, made loans, purchased securities, maintained multiple branches and acted as fiscal agents for the U.S. Treasury. In spite of economic success, the Bank of the United States was shut down by Jacksonian Democrats opposed to strong centralized government and fiscal policy.

The National Bank System, founded in 1862, converted private banks into national banks with a unified currency backed by Federal bonds. National Bank notes were acceptable anywhere in the nation, creating America’s first stable paper currency. Unfortunately, the system could not control the volatility of government bonds and seasonal variations in the money supply, eventually leading to a pattern of economic recessions.

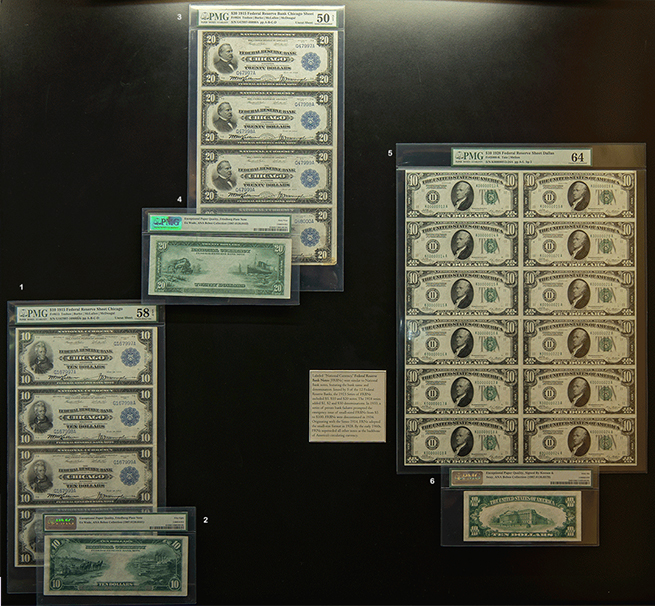

Congress responded with the FRS in 1913. It provided financial stability and public confidence through short-term loans to National Banks and insurance for depositors, thereby reducing cyclical recessions. The FRS managed the national money supply with two new banknotes: Federal Reserve Bank Notes for each bank of the 12 regional banks in the system and Federal Reserve Notes for the system as a whole.